Bloomberg by Alex Longley

Oil’s plunge through $50 a barrel set the options market on fire.

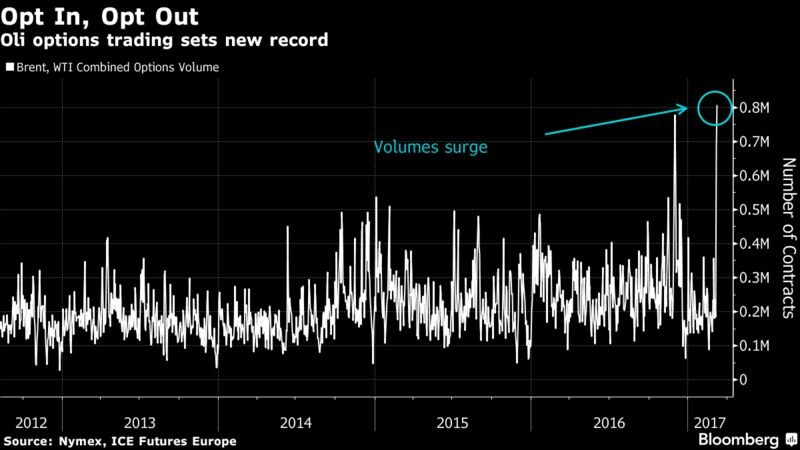

A record number of options contracts -- equivalent to more than 800 million barrels of crude oil -- changed hands on Thursday, according to exchange data compiled by Bloomberg. The tally includes trading for Brent and West Texas Intermediate crude in London and New York and shows a surge in bets that the former will reach $70 a barrel by September.

The trading, which allows investors to protect themselves or profit from price swings, takes place as the market emerges from its least volatile period in years. Since Nov. 30, when the Organization of Petroleum Exporting Countries agreed to curb output for the first six months of this year, prices have hovered above $50 a barrel. That period of calm ended as WTI fell to its lowest level since the OPEC deal, amid rising U.S. stockpiles that threaten to prolong the global glut.

“Everyone is a little afraid in the short run because who knows what the market beast might do,” Michael Poulsen, oil risk manager at A/S Global Risk Management Ltd., said by phone. “In the long run, either OPEC will cut or demand will pick up a bit of this extra supply. It’s a bit of a tango around the middle-term.”

Thursday’s activity marks the second time in a matter of months that options trading in the oil market has soared. In late November, investors rushed to make bets that prices would rise as OPEC hammered out its deal to cut production. After both Brent and WTI this week fell the most in more than a year, traders again sought to profit from market gyrations.

Record Volumes

Options trading reached its second-busiest day for both Brent crude on the ICE Futures Europe exchange in London and WTI on CME Group Inc.’s Nymex exchange in New York. The increase occurred as Brent volatility rebounded to a two-month high and the bearish bias, or skew, surged. Ten WTI options contracts saw more than 10,000 lots traded on Thursday, with five profiting from higher prices and five from lower prices.For Brent, September contracts were among the most active, with record volumes on bets that prices would hit $60 and $70 a barrel. The move toward longer-dated contracts comes as investors seek cheap protection against price swings after the next OPEC meeting in Vienna on May 25, according to Nick Williams, a commodity futures broker at GF Financial Markets Ltd.

While the number of contracts betting on $70 a barrel Brent crude by September rose by about 10,000 lots Thursday, other bullish bets declined. Brent $60 calls for both June and July saw open interest slip in spite of bumper trading. Traders are likely adjusting their expectations about when a re-balancing will arrive, said Jesper Dannesboe, senior commodity strategist at Societe Generale SA in London.

“The bullish structures may have moved their maturities longer, that would mean they’re starting to feel less confident about a near-term bullish story,” he said. “If OPEC compliance stays high and global demand stays pretty strong, the re-balancing is going to happen. ”

Comments

Post a Comment