Bloomberg by Lananh Nguyen & Robert Fullem

Dollar bears are back from the wilderness.

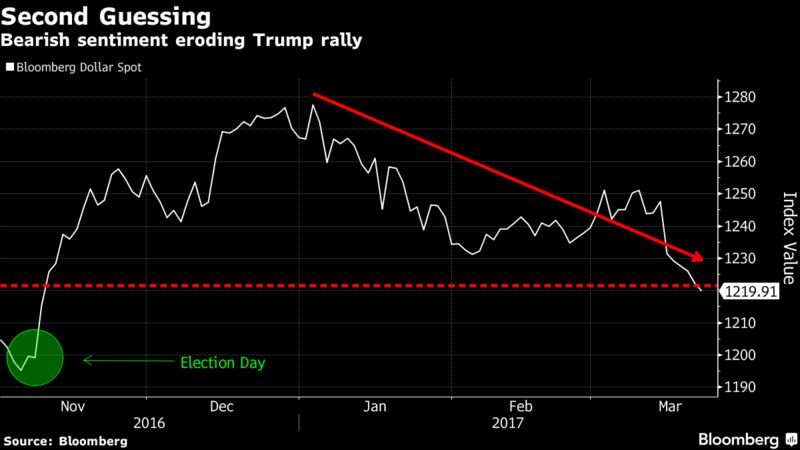

The currency slid to the lowest since November on Wednesday, and options show investors are becoming more pessimistic on the greenback versus the euro and yen. The dollar has almost erased its gains from the so-called Trump Trade, as pro-growth policies from the presidential administration have yet to materialize. UBS AG’s wealth-management unit recommended selling the dollar against the euro, and JPMorgan Chase & Co., the world’s second-biggest currency trader, advised clients to ditch bullish bets in the short term.

“The case has become more compelling” to short the dollar, said Constantin Bolz, a foreign-exchange strategist at UBS in Zurich. The bullish dollar consensus since Donald Trump’s election in November “is turning step by step” as markets question U.S. policies and their effectiveness.

UBS sees the euro-dollar exchange rate climbing as high as $1.15 over the next six months from $1.0796 Wednesday. It expects dollar-yen to fall to below 110 yen in the same period.

Technical Indicators

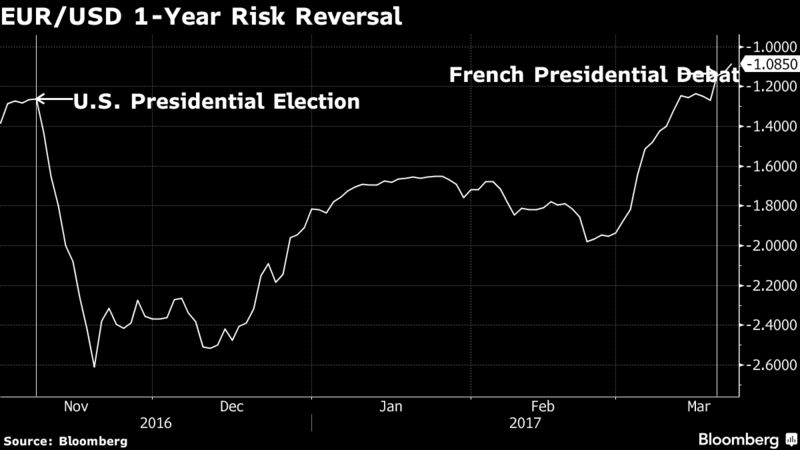

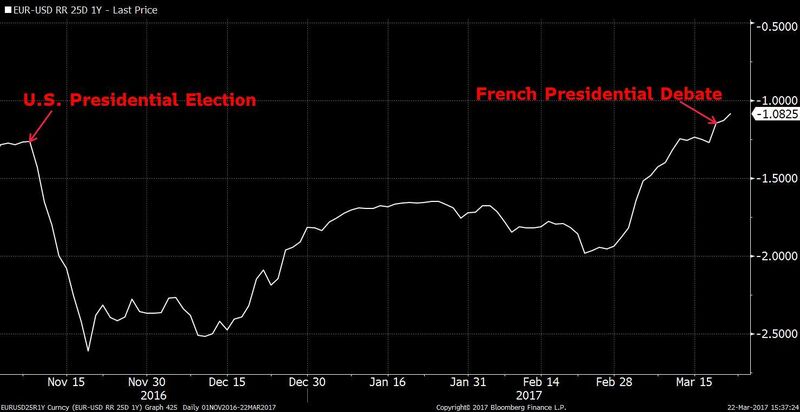

In options markets, protection against a rising dollar is getting cheaper as the outlook on the currency becomes more pessimistic. Risk reversals, an indicator of market sentiment and option positioning, have been signaling a shift away from dollar bullishness.The EUR/USD one-year risk reversal, the extra cost to protect against euro declines, versus the cost to protect against gains, has been getting cheaper and has plunged as markets discount the prospect of Marine Le Pen winning the French election.

Similarly, the dollar-yen one-year risk reversal, which reflects the extra cost of protecting against yen appreciation, has gone up. That means investors see yen gains as more likely.

Comments

Post a Comment