Bloomberg by Lu Wang & Janet Freund

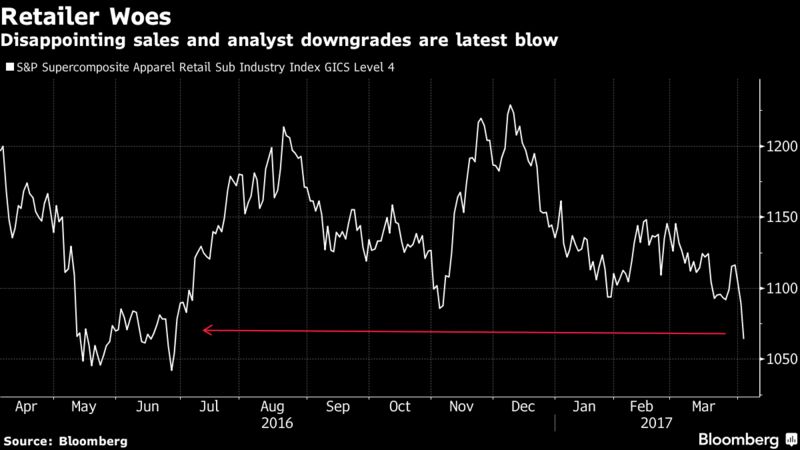

Retailers, already this year’s worst performing stocks, just got hit by a new round of bad news.

Urban Outfitters Inc. announced a decline in same-store sales while L Brands Inc. was downgraded by Citigroup Inc., whose analyst said the company has so many stores in weakening malls that its negative traffic trends “only seem to be getting worse.”

Casting doubt on broad industry demand, First Data Corp., the payments processor, said point-of-sales data for department stores slumped 10.9 percent in March.

The S&P 1500 Apparel Retail Index tumbled 2.2 percent as of 12:45 p.m. in New York, poised for the lowest close since June. All but one of its members retreated. A similar gauge tracking department stores sank as much as 4 percent.

“Even if retail sales accelerate in April, a weak start to 1Q would be hard to overcome,” Bloomberg Intelligence analyst Poonam Goyal wrote in a note.

L Brands lost 4.3 percent to a four-year low after Citigroup analyst Paul Lejuez cut the stock’s rating to neutral from buy. Lejuez also downgraded Urban Outfitters after the company said its comparable store sales fell by a "mid single digit” percentage so far in the quarter ending in April 30 . The stock dropped 4.1 percent.

Comments

Post a Comment